Citigroup in 2025: Undervalued - Turnaround in Sight?

A closer look at the numbers and history of the U.S. banking giant

A fallen angel waiting to spread its wings again? With a price-to-book ratio of 0.73, Citigroup is undervalued compared to other major U.S. banks – could this be the beginning of a comeback?

Citigroup: From Global Giant to Turnaround Candidate

Founded in 1998 through the merger of Citicorp and Travelers Group, Citigroup was one of the world’s largest financial institutions in the early 2000s. Between 2000 and 2006, Citigroup repeatedly ranked first in the Forbes Global 2000 list of the world’s largest companies.

The 2008 financial crisis hit Citigroup hard. The company had to rely on government support and initiated a far-reaching restructuring process. In the years that followed, Citigroup divested numerous business units and refocused on its core competencies.

Jane Fraser: First Woman to Lead a Major U.S. Bank

In March 2021, Jane Fraser became CEO of Citigroup, making her the first woman to lead a major U.S. bank. Fraser is pursuing a clear strategy: she aims to make Citigroup leaner, more efficient, and more focused. This includes exiting less profitable markets, investing in digital technologies, and placing greater emphasis on the institutional business.

Recent Developments and Ongoing Challenges

Under Fraser’s leadership, Citigroup has made significant progress. In 2024, the stock price rose by 37%, and the company reported revenue of $81.1 billion. Nevertheless, Citigroup continues to lag behind competitors like JPMorgan Chase and Bank of America. The bank remains under regulatory scrutiny, with authorities demanding improvements to its internal control systems.

Let’s take a look at the numbers.

According to the Q1 2025 earnings report:

Net interest income increased by +3.74%

Total revenue rose by +1.97%

Net income grew by +20.56%

Net loan volume expanded by +4.12%

Share buybacks totaled $1.75 billion

Overall, these are solid numbers. The net income stands out in particular. The bank appears to be taking its optimization strategy seriously and is successfully improving its margins. In addition, Citigroup has announced plans to continue buying back its own shares.

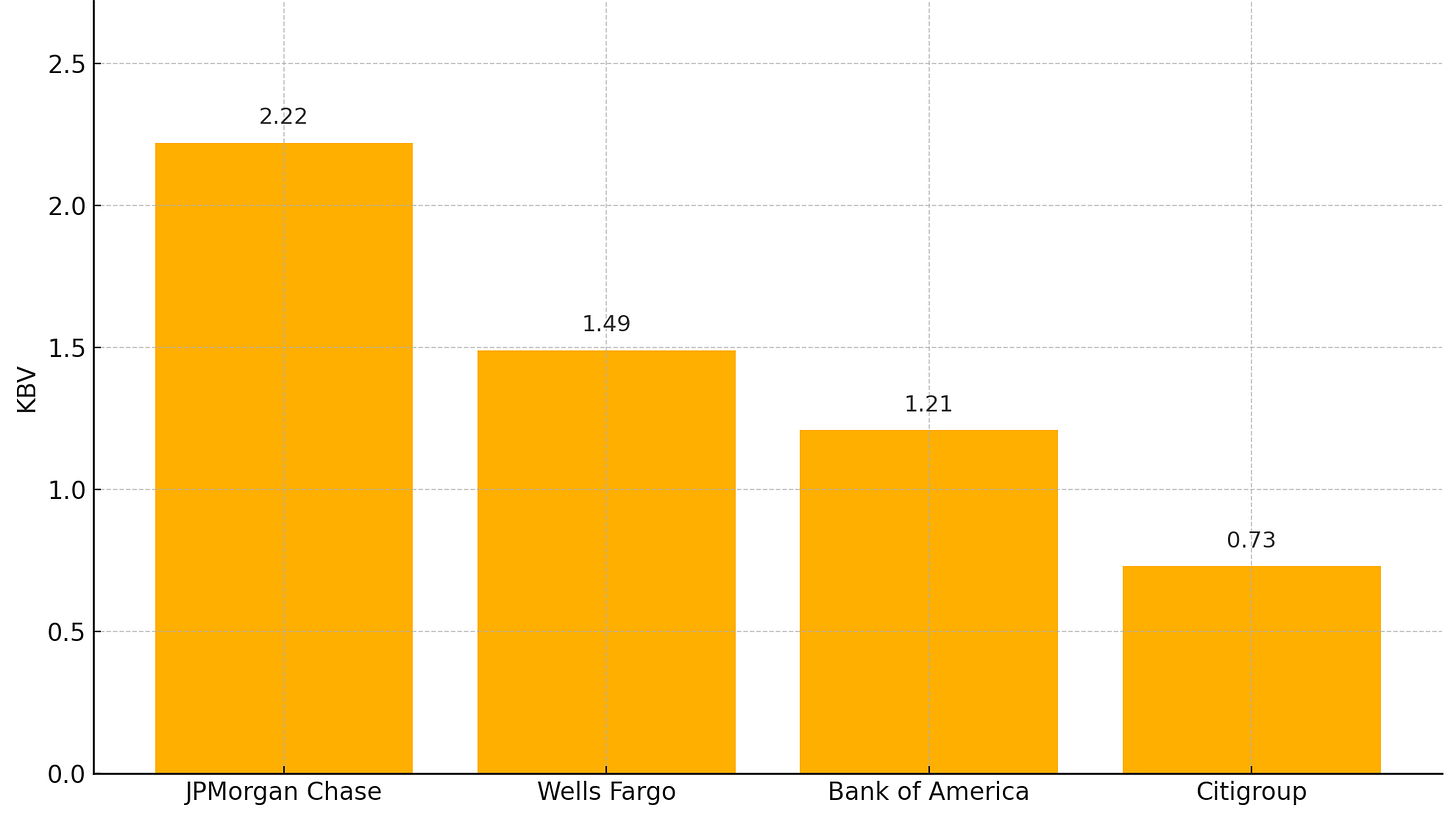

A particularly interesting metric is the current price-to-book ratio in comparison to industry peers. (source: Yahoo Finance, 30|05|2025)

As the chart illustrates, Citigroup's price-to-book ratio of 0.73 is significantly lower than that of its U.S. peers, such as JPMorgan (2.22) or Wells Fargo (1.49). Of course, there are reasons for this valuation discount — most notably, competitors are currently more profitable than Citi. Still, if the ongoing turnaround proves successful, there is considerable upside potential in the stock’s valuation.

// For those of you who may not be familiar with the price-to-book ratio (P/B): it indicates how the current share price compares to the company’s book value per share.

The formula is: P/B = Share Price / Book Value per Share.

Conclusion

A bank in transition. Citigroup is undergoing a profound transformation. With a committed leadership team and clear strategic goals, the bank has the potential to strengthen its position in the global financial system. At a price-to-book ratio of 0.73, its valuation is currently attractive compared to the industry, and the latest quarterly report offers reasons for optimism.

In my view, Citigroup is an interesting option among U.S. banking giants – especially if the planned changes are successfully implemented.

What about you? Which metrics do you consider most important when evaluating a company? Do you invest in financial stocks – or is that sector not for you?

Feel free to share your thoughts in the comments – I look forward to the exchange!

Subscribe for free to stay updated and support independent financial writing.

Disclaimer:

This content is for informational and educational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. All investments carry risks. You are solely responsible for your investment decisions. Please consult a licensed financial advisor if you require personal advice. At the time of publication, I hold a position in the security discussed in this article.